Are you searching for 'assignment fee options'? You will find all of the details here.

Designation occurs when the writer of Associate in Nursing option contract is ordered by the clearing house to buy the fundamental stock from the option holder (in the case of a put option), or sell the underlying asset to the holder of the option (in the case of a call option). Online brokers accusation fees for assignments and exercises.

Table of contents

- Assignment fee options in 2021

- Assignment real estate definition

- Covered call assignment

- Options assignment vs exercise

- Assignment of real estate contract form

- Option assignment td ameritrade

- Real estate assignment

- Td ameritrade options assignment fee

Assignment fee options in 2021

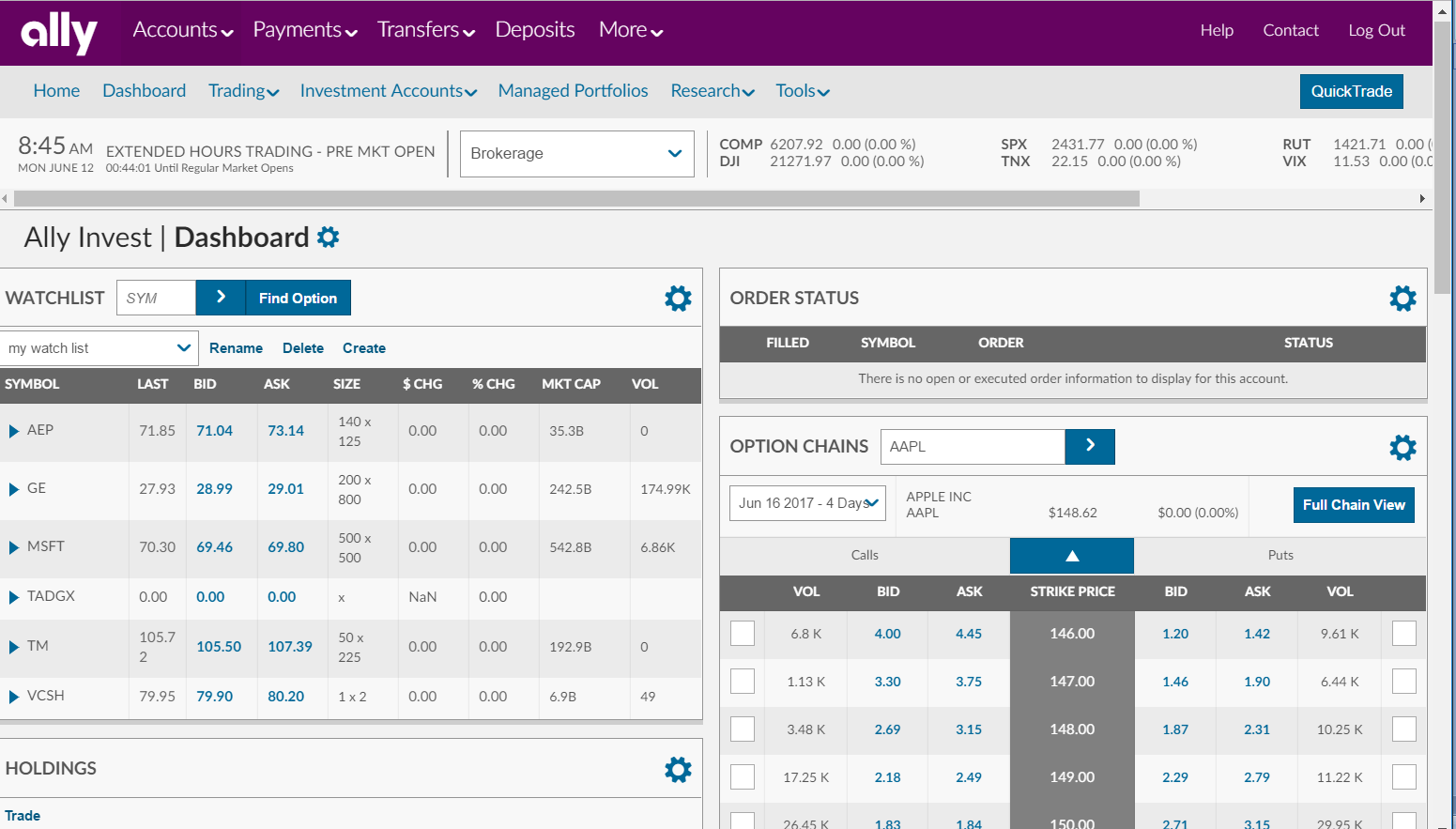

This picture illustrates assignment fee options.

This picture illustrates assignment fee options.

Assignment real estate definition

This picture illustrates Assignment real estate definition.

This picture illustrates Assignment real estate definition.

Covered call assignment

This picture representes Covered call assignment.

This picture representes Covered call assignment.

Options assignment vs exercise

This image demonstrates Options assignment vs exercise.

This image demonstrates Options assignment vs exercise.

Assignment of real estate contract form

This image illustrates Assignment of real estate contract form.

This image illustrates Assignment of real estate contract form.

Option assignment td ameritrade

This image illustrates Option assignment td ameritrade.

This image illustrates Option assignment td ameritrade.

Real estate assignment

This image representes Real estate assignment.

This image representes Real estate assignment.

Td ameritrade options assignment fee

This picture illustrates Td ameritrade options assignment fee.

This picture illustrates Td ameritrade options assignment fee.

What does the assignment fee do in a real estate contract?

In other words, the assignment fee serves as the monetary compensation awarded to the wholesaler for connecting the original seller with the end buyer. Again, any contract used to disclose a wholesale deal should be completely transparent, and including the assignment fee is no exception.

Which is an example of an assignment Contract?

For investors and traders the most prominent example occurs when an option contract is assigned, the option writer has an obligation to complete the requirements of the contract. But there are other types business transactions known as an assignment.

When does the assignment of an option take place?

Assignment takes place when the written option is exercised by the options holder. The options writer is said to be assigned the obligation to deliver the terms of the options contract. If a call option is assigned, the options writer will have to sell the obligated quantity of the underlying security at the strike price.

When does an assignment occur in a trading contract?

In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Last Update: Oct 2021